Filling out Form 1099 Nec online

Upload your PDF form

Fill out the form and add your eSignature

Save, send, or download your PDF

A complete guideline on how to Form 1099 Nec

Every citizen must report on their finances on time during tax season, providing information the IRS requires as accurately as possible. If you need to Form 1099 Nec , our trustworthy and user-friendly service is here to help.

Follow the instructions below to Form 1099 Nec quickly and efficiently:

- 01Upload our up-to-date form to the online editor - drag and drop it to the upload pane or use other methods available on our website.

- 02Read the IRSs official guidelines (if available) for your form fill-out and accurately provide all information requested in their appropriate fields.

- 03Fill out your template using the Text tool and our editors navigation to be certain youve filled in all the blanks.

- 04Mark the boxes in dropdowns using the Check, Cross, or Circle tools from the toolbar above.

- 05Take advantage of the Highlight option to accentuate specific details and Erase if something is not applicable any longer.

- 06Click the page arrangements key on the left to rotate or remove unnecessary file sheets.

- 07Check your forms content with the appropriate personal and financial paperwork to make sure youve provided all details correctly.

- 08Click on the Sign tool and create your legally-binding electronic signature by uploading its image, drawing it, or typing your full name, then add the current date in its field, and click Done.

- 09Click Submit to IRS to e-file your tax statement from our editor or choose Mail by USPS to request postal report delivery.

Choose the best way to Form 1099 Nec and declare your taxes online. Give it a try now!

G2 leader among PDF editors

30M+

PDF forms available in the online library

4M

PDFs edited per month

53%

of documents created from templates

36K

tax forms sent over a single tax season

Read what our users are saying

Learn why millions of people choose our service for editing their personal and business documents.

Questions & answers

Below is a list of the most common customer questions.

If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is the purpose of Form 1099 Nec ?

The purpose of Form 1099 NEC is to collect information from businesses regarding the income and deductions incurred and expenses incurred during the calendar year. For tax years beginning on or after January 1, 2014, the business should use this form to report on line 6 or 7 the income and any deductions that apply.

What if I am not required to report my deductions on Form 1099?

If you are not required to report the amount of income or deductions you incurred during the calendar year, but report your expenses, such as an employee's food and lodging, you should file Form 8829, Employee Expense and Credit report, instead of Form 1099 NEC.

A Form 8829 will report your expenses, so you will not have to use Form 1099 to report your income.

I filed Form 8829, but my expense was not reported on my Form 1099. Why?

Generally, any employee expense that exceeds your 600 (or your annual allowable deduction) limit is allowable only on a per-employee basis and is reported on Form 8829. For example, if your gross salary is 200,000, your food and lodging expense is 500 per employee. If your regular salary is 300,000, your food and lodging expense would be 600. You should report the amounts on separate schedules as indicated in the instructions for Forms 8829 and 8829-A.

If I have to file my annual return earlier than the deadline (the filing deadline for most filers is April 15), do my expenses count on my tax return?

Yes, if you have made the contributions required to be reported on Form 1099 by March 15, you will only need to file your tax return up to the deadline.

Can I use Form 1120, Employer's Quarterly Federal Income Tax Return, and pay any withholding?

Yes, if you are not required to report on Form 1099 and do not have to make Form 1120.

What if the information I reported is incorrect?

If your Form 1099 and Schedule C are incorrect, you will need to use Form 8829, Employee Expense and Credit report, instead.

Can I use my business name on my tax return?

You must change your business name on all information, including Schedule C, to reflect the new name. For information, call the IRS for help at.

Who should complete Form 1099 Nec ?

Form 1099-MISC for non-resident aliens/foreign individuals. Only non-resident aliens/foreign individuals can complete this form, and it is filed with IRS. Form 1099-MISC will be mailed to you by the IRS for you to file and file monthly with IRS. Non-resident aliens have a tax advantage to file this form, and it is the one that you should file because it is much easier to pay taxes, and it can be used for income from self-employment.

Where do I file Form 1099-MISC ?

To file this form you will need to either send or mail the form and all supporting documentation to:

Internal Revenue Service,

Office of Exempt Organizations

P.O. Box 47801

Baltimore, MD 2

If you do not have your own copies of the documents or if you have no way to access them you can download this copy to save from the attachment.

What do I need to send in my Form 1099-MISC ?

You must include a form of Social Security card number, the date of birth of each person on your list, and a copy of Form W-2. You also must have current, valid identification of each person in your list.

I am a Non-Residents? What do I need to send in Form 1099-MISC?

You must submit an itemized explanation of your income from any source, including:

Employing persons not a U.S. citizen or resident alien for more than 183 days during the calendar year

Self-employment income less than 600 (or 600+ income from self-employed business with less than 3,000 gross income), and

Other income less than 600 (or 600+ from self-employment business with less than 3,000 gross income).

What if I am a Nonresident Alien? Do I need to file Form 1099-MISC ?

If you are a non-resident alien you should file Form 1099-MISC with the IRS if:

You earned income from either U.S. or foreign sources or have income which would otherwise qualify you to file Form 1040NR.

You lived in the United States on more than 50% of your total days in the past 18 months.

When do I need to complete Form 1099 Nec ?

Form 1099-NEC is only required whenever taxable income is higher than 10,000 for the taxable year. We recommend using our free W-9.com to complete it.

How do I determine if an income is taxable and if so, which income is taxed?

To determine taxable income, use the W-9 form. All income earned should be marked on the Form W-9. For some income, an extra statement for the Form W-9 is required. This statement states if the income is taxable or whether the individual was a self-employed individual during the preceding year. For example, an individual who earns wages, salaries, commission, and taxable bonuses should state whether the income is taxable or not on the Form W-9. A Schedule C on an individual's Form 1040 or 1099 will list wages that are taxable by state or localities where the individual has a permanent or long-term home such as New York, Pennsylvania & New Jersey.

If the income is not taxable, the individual should mark on the W-9 that no income is earned in the past year. This statement will remove the 1099 income from our reporting and will remove the 1099 tax form from the individual's tax return.

What if a W-9 Form is wrong? Does Form 1099 NEC need to be completed?

No. The Form 1099NEC is only needed when taxable income is higher than 10,000 for the taxable year. You do not need additional information on Form 940-NEC or Form 1095-NEC when taxes are paid on a W-9 form. However, a Form 2106 is required if your W-9 is wrong due to an error in the tax code or other error from our records at the W-9 agency.

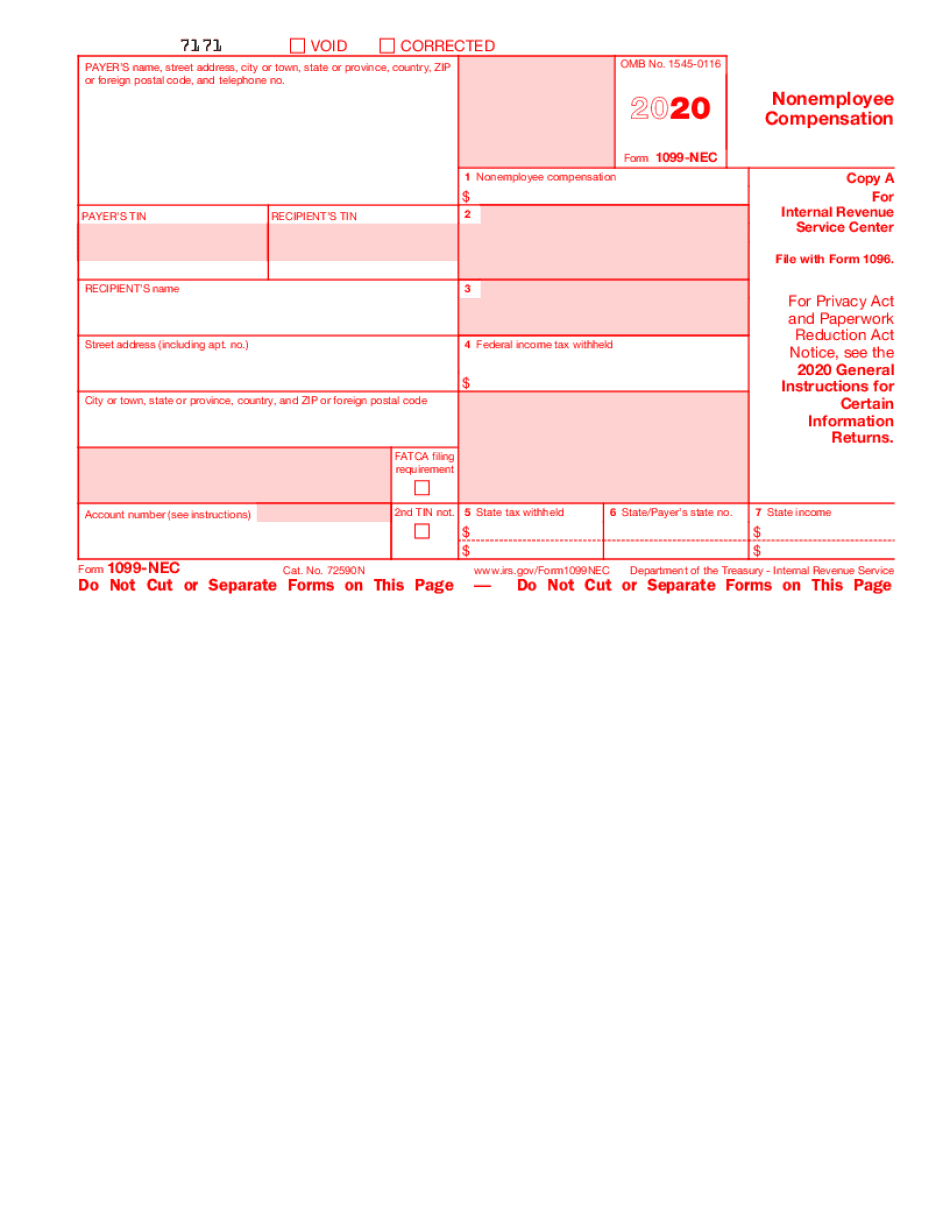

Form 1099-NEC

How does Form 1099-NEC work?

With the electronic filing of your Form 1099-NEC, we will automatically send you an electronic version of the Form 1099-NEC that includes information from the W-9. For each Form 1099-NEC you receive you'll see the itemized deductions, tax withheld, filing status, and the amount of tax withheld from each. Additionally, you'll see the taxable portion of the W-9 that is due to us.

Form 1099-NEC uses a four-digit code to identify each person that reported employment income.

Can I create my own Form 1099 Nec ?

If so, please provide the following information: — Name of employer — Name of employee — Number of employees — Date they had no compensation income from the business. — Do I have any other forms of compensation (e.g., employer contribution to 401(k) plans, etc.) — Do I have any additional payments for employee benefits. — Do I have any self-employment income (e.g., self-employment deductions, etc.) If you need further information or clarification, please contact us. What is the proper tax filing status to claim a deduction on an employer's behalf for wages paid to your employee? Do I need a Form 1099-MISC for my nonemployee employee(s) who earn wages from my business? An employee who earns wages from your business is considered to be a “nonbusiness related” employee for purposes of Form 1099-MISC. As such, the employee is subject to withholding at the employee's regular income tax rate and must provide the correct information on this tax form. If your employee receives wages of which you are the primary payer, then you must file an IRS Form W-2G (for employees) or Form W-2GS (for independent contractors); these forms will report the wages of all employees. If the employee earns wages from your business but is paid by someone else (e.g., in an employee benefit plan or profit-sharing account), then the payment must be reported on either form. An employee who works for you but doesn't receive any wage payments from you (such as by a bonus or other reimbursement) cannot claim a deduction for those wages. If you would rather file an IRS Form 1099-MISC that also includes all wages reported on the Form W-2G or Forms W-2GS, we advise that you file Form 1099-MISC-NEC, or a copy of the employee's Form W-2G. What if my employee files an election to report all wages paid, including those paid by the employer, on a Form 1099-MISC (or a copy of the employee's Form W-2G)? Any such income reported on a Form 1099-MISC must be paid by yourself or someone else (e.g., an authorized employee of a broker, dealer or insurance company). It is best to provide a receipt to your employee or include the Form 1099-MISC with your other business income.

What should I do with Form 1099 Nec when it’s complete?

If you don't receive your Form 1092, 1095 or 1099, please be sure to send us a note stating your mailing address.

If you are not an attorney, you might use this form as a sample for filing a return.

Use Form 1099-K as a sample if:

There are no withholding allowances; or

There has been no adjustment to your Form 1099-K filing status; or

You expect that after completing the form, it will be returned to the IRS by the taxpayer.

Use Form 1099-K to determine if the IRS is owed a refund. You cannot use any of the other forms that you filed.

Form 1099-K must be completed in person. To use the form in person:

Bring your completed forms and supporting documents to any IRS service center (ESC).

If you have a computer with a printer, use our online form at the following address:. For more information about electronic filing, visit IRS.gov/about/offices-visit/article2549.

Where can I view the return?

For more detailed instructions on how to file a complete return on paper, see the Instructions for Complete Form 1098, Amended U.S. Individual Income Tax Return.

I didn't receive a Form 1099-K payment in January. Is there something wrong?

If you have not received a Form 1099-K payment, you probably filed a return and the IRS issued a Form 1099-K to you in late January because the return was incomplete and the IRS was unable to process your return.

You should have received an IRS letter with instructions to pay the taxes owed on the January return you filed for the first month in 2016. Once the IRS received your January return for the full month of February, it sent you Form 1099-K. If you reported all of your income on that return, it probably should have given you the Forms 1099 for those months even if you did not report your income on the January return.

How do I get my Form 1099 Nec ?

For the 2018 tax filing period, you will receive your NEC from the IRS before you file your tax return. You should receive the NEC within 10 business days of sending your tax return or before the due date for filing your return.

What documents do I need to attach to my Form 1099 Nec ?

We ask that you attach the following documents to your 1099NEC or 1097 form:

In addition, you must attach a copy of your valid driver license or identification card.

If you do not attach a valid driver license or identification card with your Form 1099 NEC or Form 1097, we will not be able to determine that your Form 1099 was filed.

You will not be able to receive a refund if your Form 1099NEC or Form 1097 is incorrect or does not meet the required requirements.

If you are not sure about the accuracy of a 1099NEC or Form 1097 you received, contact Us.

What if my Form 1099-MISC is incorrect or does not meet the requirements ?

If you received a Form 1099-MISC because you were not required to attach a Form W-2, IRS believes that the 1099-MISC filing might not meet these requirements:

It was made prior to a scheduled tax year.

The value of goods or services provided is less than 600.

It was made solely or principally to meet a bona fide personal need in the calendar year.

The employee's compensation for services was not equal to or greater than 600 during the calendar year.

The employee was not in the United States at any time during the calendar year.

The employee is not allowed to file Forms W-2 or 1099-MISC.

For other information about W-2, 1099-MISC, and other forms filed, read IRS Publication 926.

What if I already filed a Form 1099-MISC and need to update my information ?

If you already filed a Form 1099-MISC and want to update your information, you should take your original Form 1099-MISC and a copy of the new Form 1099-MISC.

A Form 1099-MISC filed prior to your change of address (form 1099-MISC-P, for example) should be mailed to the address on the form.

We will update all information reported in your Form 1099-MISC if you do not submit a copy of your original Form 1099-MISC or current Form 1099-MISC.

What are the different types of Form 1099 Nec ?

As shown in figure 1 below,

Form 1099-NEC is the amount reported on a Form 990 in the amount of income reported as wages for which an employer withholds W2 from the employee.

A Form 1099-NEC is only a paper form and the recipient will not know this information on their forms. It does not require any additional data fields.

Form 1099-PF is the same as Form 1099-NEC except it requires information to be reported for the employment earnings of the recipient, if any. This information should be reported on the Form W9, Wage and Tax Statement.

There are other types of Form 1099 (i.e. 1099.9, 1099.9A). These forms use different reporting criteria than the 1099-NEC, but the recipient can use this form to fill out a Form W-2 for the employee for any taxable year for which wage information was not reported in the Form 1095-A.

Form 1099 should be considered an alternative to a Form W-2 for reporting the employer's employment earnings and not required by any state except the following states: Hawaii, Idaho, North Carolina, South Carolina, Tennessee, Virginia, West Virginia.

What are the basic reporting values for Form 1099-NEC?

The total number of wages reported are shown on the form by the employee's tax identification number,

the total number of months were the wages paid are shown on the form by the tax year,

the total number of payroll periods ended are shown on the form by the business' tax year, and

The total number of wages reporting periods are shown on the Form 1099-PF and must show a value from the prior tax year.

How can Form W-2 and Form 1099-NEC be combined?

For most situations, it is sufficient for the person to use one form for reporting the employment and the other for reporting the taxable wages and taxable income. However, if certain circumstances apply, a Form W-2 must be filed. The following situations apply to this scenario.

Employees who received cash wages for more than three (3) full pay periods, or were a resident of a state with an employment tax.

Employees of a foreign organization which makes a business purpose in the USA but are located in a state with no personal income tax.

How many people fill out Form 1099 Nec each year?

We estimate between 30,000 and 40,000 in the US. That's a significant number, which is why we do this study every year. The vast majority of those are for the purpose of selling products under a brand name with a retail price of under 10,000. This report looks at the tax consequences of form 1099 that is issued in connection with these sales.

The IRS has released guidelines detailing the tax consequence of 1099s.

Form 1099 is not a Form 1099-MISC and may trigger Form 951 reporting to the IRS.

It is very important to distinguish between 1099 and Form 1099-MISC.

A Form 1099-MISC generally indicates that a person received compensation for sales of securities or services while reporting income under a Form 1040 or Form 1040A. It also generally indicates that the person received compensation for other business activities.

A Form 1099-MISC generally may not constitute income as defined by the Internal Revenue Code. A Form 1099-MISC is simply a form given to a person to describe his earnings.

The IRS typically requires recipients of the Form 1099-MISC to file a form with the IRS showing details of their income and deductions.

On the other hand, Form 1099 may be required on the books of a business as a statement of taxable income for accounting purposes. This statement usually indicates a payment (whether it be in cash or in-kind) received from a customer for a good or service. In a few cases, the IRS will require a 1099 when a salesperson received compensation for selling securities on behalf of a publicly traded company.

If Form 1099 is used to receive compensation, the IRS will provide an instruction letter and form 1099-MISC to the person using the 1099.

When we prepare a list of businesses that have paid out 1099s in our study in 2016, we found that they made purchases of stocks (excluding financial instruments).

In 2016, the top 10 recipients of a Form 1099 were:

Companies that engaged in the securities and/or trading business, primarily through trades on the New York Stock Exchange (NYSE). The largest recipient of 1099s as proportion of total 1099 registrations in 2016 was The Boston Beer Company, with a market capitalization of 18 billion.

Is there a due date for Form 1099 Nec ?

There is no due date on Form 1099-NEC. You must make your Form 1099-NEC as an extension of time. For example, you make a Form 1099-NEC for the year in which you made the interest payment. The due date to file is the date you filed your return. To file Form 1099-NEC as an extension of time, you must file Form 1040X, Amended U.S. Individual Income Tax Return. In any case, we encourage you to make Form 1099-NEC if: You received an election to file a Form 1099-NEC for the year you made the interest payment.

You received an extension to file in connection with a tax year.

We make an election to show interest on Form 1099-NEC when: You receive a Form 1099-NEC for the year your income tax return was due.

You were a U.S. citizen for a period of 7 years ending with the date you made your interest payment. Do I need to report interest paid on a Form 1099-NEC? Yes, you will be required to include interest income on a Form 1099-NEC. You may not include any other income. You generally need to report interest income on a Form 1099-MISC. Do I have to report interest on both a Form 1099-NEC and a Form 1099-MISC ? No. The Form 1099-MISC is only required to show interest, not any other income. If you do want to report interest income on just one of these forms, a separate Form 1099-MISC is required. Does my Form 1099-MISC provide information on the income I receive? Yes, all form 1099-MISC information is provided under the heading “Interest paid.” Do I have to include interest income on a tax return for each pay period in which I receive interest income? No, interest income includes any tax-exempt interest and interest paid on any other source of income. My spouse made a Form 1099-MISC for interest on the interest payment that I received over an 18-month period, but I do not earn any interest. Do I report interest income from this source on my income tax return? It is not considered income to the extent it is not reported on Form 1099-MISC. The payer is responsible for reporting the tax amount received on his own income tax return.

Popular Forms

If you believe that this page should be taken down, please follow our DMCA take down process here